Complete Response Letters (CRLs): Big Trouble for Small Pharma

Updated on: February 9, 2021

Updated by: Stacey A. Ayres, PhD, VP of Regulatory and Strategy

While the analysis in this blog post was conducted in 2018, the takeaway still rings true today: CRLs can have a devastating impact on emerging biopharma development programs, and small companies are particularly susceptible to the pitfalls that lead to their receipt.

An EP Vantage analysis of publicly reported* Complete Response Letters (CRLs) issued by the FDA from January 1, 2017, until May 30, 2018, had surprising results: Of those that were analyzed, small companies received most of the CRLs. A CRL can have a devastating effect on a small company’s share value, as evidenced by the examples of Adamis Pharmaceuticals and Aquestive Therapeutics.

So why are small and specialty pharma companies struggling to get first-cycle approvals? EP Vantage suggests that several factors may be involved in the overrepresentation of small pharma in the list, including the difficulties of smaller companies in recruiting staff with appropriate regulatory expertise. Here we take a closer look at who received the CRLs and what the deficiencies were.

*The actual number of submissions and CRLs is not known since privately held companies do not have to share this information.

What Is a Complete Response Letter?

A CRL indicates that the FDA has conducted a complete review of the data in an NDA, ANDA, or BLA submission and subsequently found that it cannot approve the application in its present form. Each CRL details the reasons that the submission was found to be inadequate and often includes recommendations from the FDA on how the sponsor can address the deficiencies.

The use of CRLs was codified for drugs in 2008 and earlier for biologics, to replace the previous system of “approvable” or “not approvable” letters for drug products.

Who Received Complete Response Letters?

Small Pharma Companies

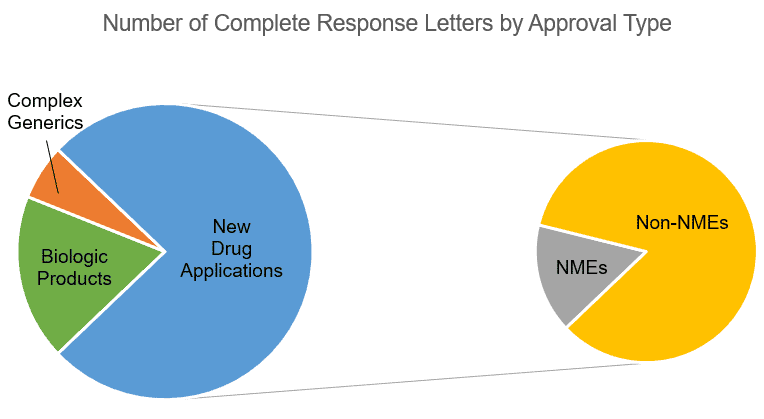

In the period analyzed, the list assembled by EP Vantage contained 33 applications for which the FDA issued a CRL (not including supplemental NDAs):

- Six biologic products (four potential biosimilars and two BLAs)

- Two complex generics (Both ANDAs used Advair Inhalant as their reference product.)

- 25 NDAs, consisting of four New Molecular Entities (NMEs) and 21 non-NMEs

Notably, of the 12 applications for approvals of biologics, complex generics, and NMEs, all but two were from large pharma. All 21 of the non-NME NDA submissions attracting CRLs were from smaller pharmaceutical companies, according to the company size classification system applied in the EP Vantage analysis.

CRLs publicly reported from January 1, 2017, until May 30, 2018

Drug Improvement Product Sponsors

In a joint effort with EP Vantage, Premier Consulting discovered that 80% of the CRLs analyzed were issued to companies developing drug improvement products via the 505(b)(2) pathway, all of which were small companies.

In an earlier analysis, we noted that almost 50% of products approved via the 505(b)(2) pathway in 2017** were submitted by sponsors that had four or fewer approved products in the US. For 30%, the drug improvement approval was the sponsor’s only FDA-approved product. At the other end of the spectrum, only 23.8% of the approved drug improvement products were from large pharma (companies with more than 100 products approved by the FDA). Small companies seem to achieve half of the drug improvement approvals yet receive a disproportionately high number of CRLs prior to approval.

There are two main reasons that smaller companies struggle with drug improvement approvals more than larger pharma:

- Smaller companies often handle more complicated drug improvement NDA submissions such as drug-device combination products, new indications, or changes in route of administration to approved products. In contrast, large pharma often focuses on minor changes to dosage forms, excipient changes, or changes to the release profile of a product. While all of the changes mentioned above can be challenging depending on the circumstances, the more complicated products typically need more attention to CMC, human factors studies, and clinical strategy to obtain a first-cycle approval.

- The regulatory nuances of the 505(b)(2) pathway are often underappreciated. Therefore, investors and regulatory teams more familiar with novel products often believe that the approval of an improved drug will be straightforward, since it is already approved in a different form. This can be an overly optimistic judgement without appropriate and extensive 505(b)(2) regulatory expertise. Problems that are not encountered in traditional programs can arise with CMC, scientific bridging, and justifying data in the published literature, and the problems are compounded further with the level of complexity of the product.

**It must be noted that (a) the time period for EP Vantage’s analysis extends until May 2018, while our analysis includes on the calendar year 2017 and (b) the analyses’ metrics for classifying large and small companies are different.

What Were the Reasons for the CRLs?

Although some companies analyzed did not share the details of the deficiencies noted in their CRLs, 14 of the 21 non-NME NDA submissions (67%) did. CMC issues were common (at least six applications), and three products required additional human factors and usability engineering studies. Two applications required more robust analyses of their clinical data, and at least five of the application sponsors were asked to conduct additional clinical studies.

Many of these issues could have been foreseen and dealt with constructively prior to NDA submission. A well-planned strategy and productive communication with the FDA at milestone meetings throughout development will bring many of these issues to light before a CRL becomes necessary.

In summary, while smaller pharmaceutical companies received almost all of the CRLs for new drugs, this may be attributable in part to the complexity of the products they develop, and in part to a lack of specialized 505(b)(2) regulatory and CMC expertise.

While it is sometimes possible to muddle through the regulatory process without such experience, the result is often a larger development program than necessary. Contact Premier Consulting to find out how we can help plan your development strategy to save development time and costs and to avoid a CRL.

Author:

Angela Drew, PhD

Product Ideation Consultant

Acknowledgement: The CRL list was provided by Amy Brown, Senior Reporter, EP Vantage.